Advanced accounting test: Pre-employment skills assessment to hire the best candidates

Summary of the Advanced Accounting (GAAP) test

The advanced accounting (GAAP) test evaluates candidates’ accounting knowledge, including posting and calculating accounting figures and managing financial records according to GAAP. It helps identify candidates with strong accounting/bookkeeping skills.

Covered skills

Defining basic terminologies and accounting concepts

Posting figures in the correct accounts and on the correct side (Dr/Cr)

Calculating accounting figures

Managing accounting figures and financial records

Use the Advanced Accounting (GAAP) test to hire

Accountants, bookkeepers, and other roles requiring strong accounting expertise.

Type

Time

Languages

Level

About the Advanced Accounting (GAAP) test

Good accounting practices enable your company’s management to make better decisions based on accurate financial statements and projections. It also affords your organization peace of mind knowing that all your bills, payments, and tax filings are taken care of and in good order.

This accounting test assesses candidates’ ability to define basic terminologies and accounting concepts, post figures in the correct accounts and on the correct side (Debit/Credit), calculate accounting figures, and manage accounting figures and financial records. It helps you identify candidates with strong skills who can take over or set up your company’s accounting practices.

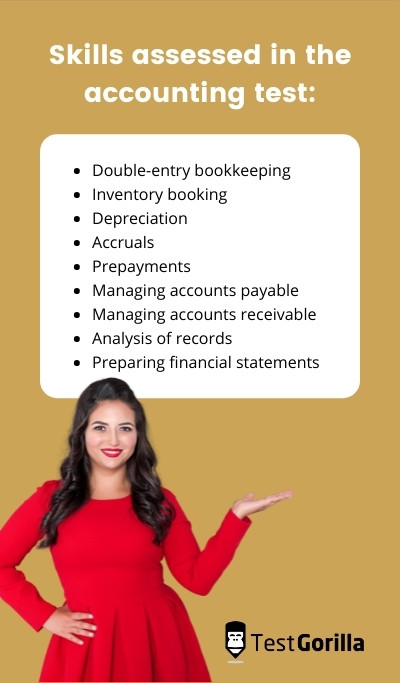

Candidates who perform well on this test can competently complete core accounting tasks such as double-entry bookkeeping, booking of inventory, depreciation, accruals, and prepayments. They can also manage accounts payable and accounts receivable, perform analysis of records, and prepare financial statements.

This test follows the generally accepted accounting principles (GAAP), as all concepts, terminology, and test questions align with GAAP.

The test is made by a subject-matter expert

Tanuja C.

Financial planning, tax advisory, bookkeeping--these are only a few of Tanuja's professional expertise. A chartered accountant since 2015, Tanuja has worked with companies on a global scale, including Ernst & Young, one of the “Big Four” firms in accounting.

Tanuja loves going beyond day-to-day operations to apply her financial finesse through mentorship and by developing finance-related case studies for undergraduate, graduate, and MBA finance courses.

Crafted with expert knowledge

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation. Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject. Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

What our customers are saying

TestGorilla helps me to assess engineers rapidly. Creating assessments for different positions is easy due to pre-existing templates. You can create an assessment in less than 2 minutes. The interface is intuitive and it’s easy to visualize results per assessment.

David Felipe C.

VP of Engineering, Mid-Market (51-1000 emp.)

Any tool can have functions—bells and whistles. Not every tool comes armed with staff passionate about making the user experience positive.

The TestGorilla team only offers useful insights to user challenges, they engage in conversation.

For instance, I recently asked a question about a Python test I intended to implement. Instead of receiving “oh, that test would work perfectly for your solution,” or, “at this time we’re thinking about implementing a solution that may or may not…” I received a direct and straightforward answer with additional thoughts to help shape the solution.

I hope that TestGorilla realizes the value proposition in their work is not only the platform but the type of support that’s provided.

For a bit of context—I am a diversity recruiter trying to create a platform that removes bias from the hiring process and encourages the discovery of new and unseen talent.

David B.

Chief Talent Connector, Small-Business (50 or fewer emp.)

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Watch what TestGorilla can do for you

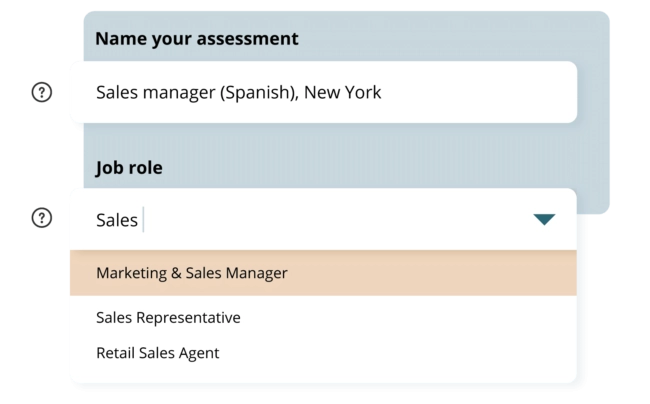

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

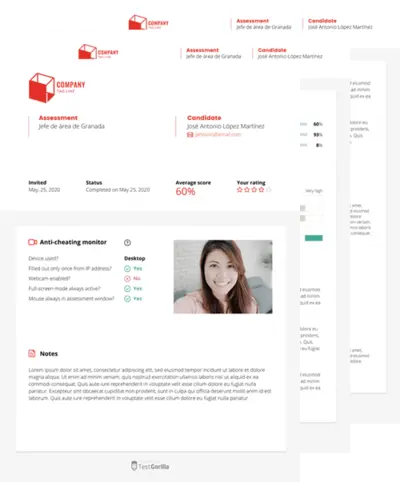

View a sample report

The Advanced Accounting (GAAP) test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.

The benefits of having a good accountant in your organization

Accounting plays a key role in providing investors, management, and governing bodies with quantitative financial information that can be used to run businesses. Accountants are the key to tracking revenues and expenses and ensuring regulatory compliance. They are also critical in helping senior management make business decisions that have cost implications.

There are many skills that accountants bring to a business, including the ability to file an annual tax return. In fact, there are six benefits of having a good accountant in your organization:

Saves time: Great accountants know the ins and outs of their responsibilities and know how to give you professional advice regarding tax, keeping up with all the compliance, reducing your taxable income, and so on. With it, they tend to save the business a lot of time.

• Saves money: Good accountants will be up-to-par with all the latest regulations, so they will know what systems need to be changed to adhere to tax regulations. This will save you both time (you won’t have to think about it) and money (since they will take care of adapting the systems to ensure they’re compliant).

• Creates all-in-one systems: Great accountants will eliminate complexity wherever they can. So when it comes to bookkeeping, they will try to set up an all-in-one system that has all of the accounting and bookkeeping tasks in a single place.

• Corporate compliance: There are regulations that corporations need to adhere to and a good accountant will help with that. Whether it’s tax returns, business activity statements (BAS), or installment activity statements (IAS), a good accountant will make sure that your organization is compliant with all of them.

• Prevents you from receiving tax penalties: Great accountants will ensure that they keep the organization compliant with tax laws, rules, and regulations, so that you don’t have to pay any tax penalties.

• Helps with future projections (budget): A good accountant will help by providing future projections regarding the budget. They will update the managers on expenses, debt, and gross margins, so that the leaders of the organization can make better decisions.

The right candidate

The right accountant will have more than just accounting and bookkeeping skills. They will also have the following skills:

• Strong written and oral communication: Even though accountants spend most of their time working in books (with numbers), they still need to have good communication skills. They will have to break down complex financial information into easy-to-digest terms.

• Organization and attention to detail: Organizational skills are a must for any accountant out there. They need to be attentive to small details because they’re dealing with finances and regulations. Therefore, a good accountant will be highly organized and will pay attention to the details.

• Analytical and problem-solving skills: Good accountants will have great analytical capabilities. They will work with a lot of financial information and they will need to analyze the data to get valuable business insights. They will also have to apply this knowledge and solve problems on an everyday basis.

• Time management: Great accountants will be aware of the many projects that are happening in the organization and will track all of them. They will keep detailed calendars for each project and track their expenses. On top of that, they must handle their daily to-do lists, so they need great time-management skills to keep up.

• Systems analysis: A good accountant will analyze the company’s finances in their entirety, taking a holistic approach. They will analyze the systems to find bottlenecks and then try to fix them.

• Critical thinking: Good accountants will try to get as much information as possible before making a decision; and to make a correct one, they will have to apply critical-thinking skills.

• Active learning: Laws, rules, and regulations are changing almost on a daily basis, so a great accountant will keep learning new things about their vocation so they stay up-to-speed.

• Proficiency in Microsoft Office: Good accountants will know their way around Microsoft Office tools, especially Microsoft Excel.

But how do you find which applicant is the best suited to the position? With an accounting skills assessment, you can evaluate all your candidates and see who has the best accounting skills. Let’s explain:

How can the accounting skills test help recruiters hire?

Hiring a good accountant means verifying the skills on a candidate’s CV and ensuring that they have all the skills that are needed for succeeding in the job. An accounting skills assessment will help you with that. By giving job applicants a pre-employment test, you can give every candidate an opportunity to showcase their skills, while ensuring that the process remains bias-free.

With TestGorilla’s accounting skills assessment, you will receive results that are fair, objective, and quantifiable (numerical). On top of that, the test is simple and easy to use. so It doesn’t make any difference for the hiring manager if they have 50 or 350 applications for the role, since they can distribute the test with a single click.

Why an accounting skills assessment is important

The accounting skills assessment or test will help you evaluate the candidate’s knowledge of accounting. The test will let you know how the applicant fares when it comes to:

• Calculating accounting figures• Managing financial records• Keeping up with key accounting concepts

This accounting skills test will help you verify a candidate with strong accounting and bookkeeping skills.

You need good accounting in your organization. Accountants enable the managers of your company to make better decisions that are based on accurate financial statements and projections. On top of that, a good accountant will keep up with all the bookkeeping tasks, such as paying bills, taking care of payments, and filling in tax forms, to keep everything in good order.

The accounting skills assessment will help you assess whether your candidates know and understand:

• Basic terminologies and accounting concepts• Posting figures on the correct accounts and sides (Dr/Cr)• Calculating account figures• Managing the company’s financial records

With the accounting skills assessment, you can recruit an accountant who can take over your accounting practices and help to ensure that your business runs as smoothly as possible.

The accounting skills test results will let you know which candidates know how to do the following:

• Double-entry bookkeeping• Inventory booking• Depreciation• Accruals• Prepayments• Managing accounts payable• Managing accounts receivable• Analysis of records• Preparing financial statements

In summary

A pre-employment test will help you verify applicants’ skills and find the best candidates to interview. Using an accounting skills assessment will give you bias-free, objective, and quantifiable results. Add TestGorilla’s accounting skills test to your hiring process to hire the best possible accountant and avoid expensive mis-hires.

FAQs

Related tests

AI Product Manager

Computer Networking Fundamentals

LinkedIn Advertising

Design Thinking

International Trade Law

Data Storytelling

Shift Coordination

Training and Development

Pharmacist

HIPAA